Company Update / Telecommunications / IJ / Click here for full PDF version

Author(s): Giovanni Dustin ;RyanDimitry

- 1Q24 core profit was formed 25% of our FY24F - in-line.

- EBITDA improved by +2% yoy in the quarter and in-line with ours/consensus; amidst solid topline delivery and better cost discipline.

- Revenue (+4% yoy) also met our expectations; we fine-tune 's FY24-25F EBITDA by 2-3% but reaffirm Buy.

In-line core profit and EBITDA

booked 1Q24 net profit of Rp6.1tr (-6% yoy/+20% qoq) - in-line with consensus (23% of FY24F). Stripping off the impact from unrealized gain on change in fair value of investments (Rp403bn), 1Q24 core profit reached Rp6.5tr (+5% yoy/+13% qoq) and is in-line with our forecasts (25% of our FY estimates). Meanwhile, EBITDA came in at Rp19.4tr (+2% yoy/+5% qoq) in the quarter, in-line with our/cons forecasts (at 24%). This implies EBITDA margin of 51.9% (-74bps yoy/+313bps qoq). Notably, cash opex rose by +5% yoy, though declined by -8% qoq, in-line with seasonality.

Revenue met our/consensus estimates; Tsel posted better performance

1Q24 revenue came in at Rp37.4tr (+4% yoy/-1% qoq) - in-line at 24% of our/consensus FY24F. Cellular revenue rose by +2% yoy, likely supported by a full-quarter impact from its c.6% selective price hikes in Nov23, though still declined by -3% qoq due to seasonal factors. We await more details from 's info memo for operational data, but the initial read-through looks largely positive for Tsel, and hence the sector. Consumer revenue was flat yoy, but declined by -16% qoq, while enterprise revenue decline by -1% yoy, but rose by +23% qoq. WIB revenue increased by +18% yoy/+4% qoq.

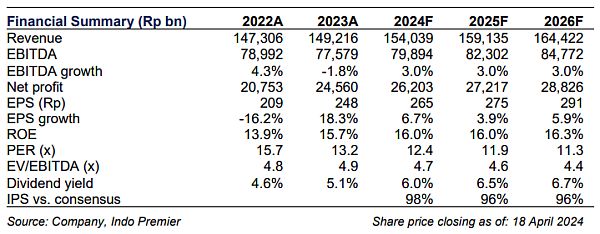

Maintain BUY, with slightly lower TP of Rp4,200

Despite the in-line results, we fine-tuned our model and trimmed 's FY24-25F EBITDA by 2-3%, mainly to factor-in FY23 and 1Q24 data points, as well as a slightly higher cost base. Note that we left our Tsel's assumptions largely unchanged, as we continue to believe that the monetization narrative remains intact. As such, we see the recent share price pullback as an opportunity to accumulate telco names, including (see our previousnote). We maintain our BUY rating on with a slightly lower blended valuation-based (DCF and EV/EBITDA multiple) 12-month TP of Rp4,200 (vs. Rp4,400 previously). We await more details from 's info memo and earnings call on 23rdApr. Downside risk is intensifying competition.

Sumber : IPS

powered by: IPOTNEWS.COM